Now or never for the massive EU Mercosur deal

After more than 20 years of negotiations, pressure is growing for the massive trade agreement to be resolved or resigned, writes William Lee, analyst at Secure Value...

After more than 20 years of negotiations, pressure is growing for the massive trade agreement to be resolved or resigned, writes William Lee, Director at business intelligence consultancy, SecureValue...

One of the great certainties of international relations is that the long-awaited trade deal between the European Union will never happen. Mercosur, a customs union in Latin America’s southern cone signed a free trade agreement (FTA) with the EU in 2019 after a hefty 20 years of talks. However, it has again stalled and is at risk of collapse – mainly due to environmental conditions from the European side and demands for greater leeway over public procurement from Brazil and Argentina.

Like Sisyphus, just as the two sides appeared to have finally got there, finalisation of the deal appears to be slipping away. Paraguay’s president, Santiago Peña, expressed the frustration of many when he said he would break off negotiations with the EU if a deal is not reached by the 6th of December 2023, when Brazil hands over Mercosur’s rotating presidency to Paraguay.

Can Spain save the deal?

However, with Spain adopting the 6-month rotating presidency of the EU in July, could the bloc’s labyrinthine workings align fortuitously to save the FTA with Mercosur and put European-Latam commercial relations on an improved footing longer term?

Spain took on the EU’s rotating presidency for the second half of 2023. Despite uncertainties surrounding the domestic political situation - the country remains without a permanent government following an inconclusive general election in July 2023 – caretaker prime minister Pedro Sanchez has been active in promoting diplomatic relations with Latin America. The EU and the Community of Latin American and Caribbean states (CELAC) held their first summit in eight years on July 17-18th, bringing together 60 heads of state from the two regions in Brussels. In October an informal meeting of trade ministers and representatives took place in Valencia, Spain, with the Spanish government aiming to make progress on the Mercosur deal as well as an FTA with Chile.

In many ways, boosting trade between Europe and Latin America is a natural fit. They are relatively close and accessible geographically and many countries share historic cultural ties and languages. Furthermore, the evolving geopolitical context gives added impetus. Latin America is rich in the raw materials that Europe needs for the global energy transition. It could also serve as a location for European companies to re-orientate their supply chains away from China as tensions over the Asian giant’s global ambitions and stance towards Taiwan rise. As access to the Chinese market becomes increasingly complex, an FTA with Mercosur and other Latin American countries would help the EU to expand its export markets.

Latin America is also well-placed given rising geopolitical tensions elsewhere in the world. It is on the sidelines of US-China tensions, is relatively neutral on Russia - despite Russian links to Venezuela and Cuba - has few links to the war in Ukraine and is insulated from the current tensions in the Middle East. The EU can also act, with US support, as a useful counterweight to Chinese influence in the region.

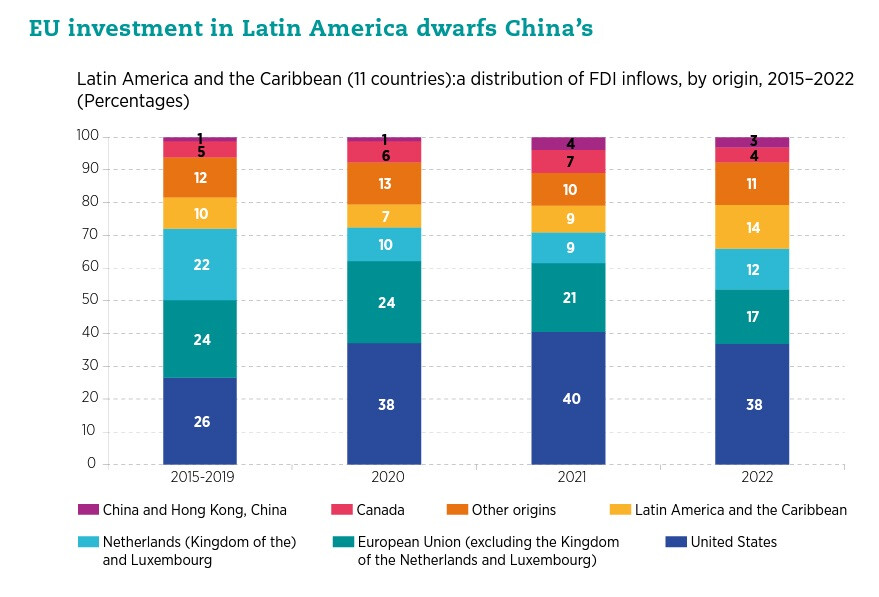

Although China has risen in prominence as a source of FDI in Latin America over the past two decades, particularly in countries, such as Venezuela, Argentina and Ecuador, the EU as a bloc has outspent China. According to a recent CEPAL report, the EU accounted for 29% of total FDI in Latin America in 2022, behind the US on 38% but well ahead of China on 4%. Nadia Calvino, Spain’s deputy prime minister, during a meeting organised by the Development Bank of Latin America (CAF) ahead of a meeting of EU finance ministers held in Santiago de Compostela in Spain, claimed that trade between the EU and Latin America had expanded by 40% in the past decade. Latin American governments are keen to benefit economically from closer EU ties.

Potential hurdles

Despite an easing of sanctions by the US on Venezuela this week the Maduro government’s democratic credentials and human rights record will remain a barrier. That said, one of the key demands to emerge from the Brussels meeting—from which Nicolas Maduro was absent—was a consensus on the need to hold credible elections in 2024 in order for economic sanctions to be withdrawn and trade and investment flows to normalise. This appears to be happening, as Maduro last week agreed to hold competitive elections, although it remains to be seen how free and fair they will actually be given the high risk that Maduro could lose power.

the EU accounted for 29% of total FDI in Latin America in 2022, behind the US on 38% but well ahead of China on 4%.

There are also differences on the war in Ukraine. Latin American leaders, headed by Brazil’s president Lula, have taken a softer line on Russia than the EU. They are generally keener to reach a settlement soon, while many have adopted a more traditional “non-aligned” position on the issue. Indeed, most Latin American nations were part of the Non-Aligned Movement - a grouping of over 100 nations that did not formerly align with any major power bloc - during the Cold War

There are also questions over how strong the pipeline of interesting investment opportunities is – European companies are not going to risk precious capital to satisfy ministers’ geopolitical goals.

However, Latin America’s relative insulation from geopolitical tensions, a growing desire on the part of the EU to compete with the US and China for global influence and a need to ensure greater access to raw materials are all major positives. Perhaps this new reality will be underscored by that deal with Mercosur being finalised after all.