Latin America's Post-Pandemic Economic Recovery is Underway

Pollyanna De Lima, Economics Associate Director, Economic Indices, IHS Markit, latest analysis reveals that the region's major economies are bouncing back in 2021...

Pollyanna De Lima, Economics Associate Director, Economic Indices, IHS Markit, analyses the latest data from the region as it recovers from the pandemic...

The second quarter of 2021 presented many challenges for Latin America economies, with a surge in COVID-19 cases triggering the reintroduction of restrictions on mobility and hindering economic recoveries. Market confidence took a hit and inflationary pressures intensified amid input supply bottlenecks. In Colombia, the 'El Paro Nacional' severely constrained business activity. Growth prospects remain susceptible to the pandemic and the potential of new strains of COVID-19 that are resistant to vaccines. Yet, fiscal support, low interest rates, adaptation to restrictions and growing vaccine coverage are all expected to support a recovery in 2021.

Official GDP data, only available up to the first quarter, pointed to annual growth of economic activity in Argentina, Brazil and Colombia. Mexico registered a further, albeit softer, contraction. Compared with the prior quarter, expansions were evident in all four nations.

"National protests in Colombia dragged the manufacturing industry back into contraction in May…"

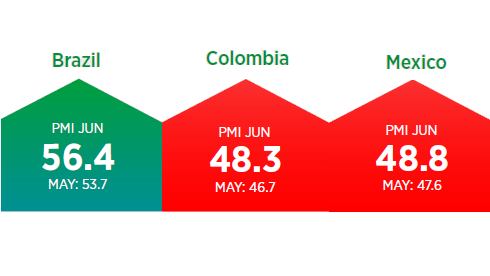

PMI data, compiled by IHS Markit, painted a mixed picture for Latin America. Brazil's private sector output returned to growth in June, after contracting in each of the prior five months. A rebound in demand halfway through the year and strengthening business confidence led firms to resume hiring. Price data, meanwhile, showed one of the sharpest increases in both input costs and selling charges since data became available in March 2007.

National protests in Colombia dragged the manufacturing industry back into contraction in May. There were softer albeit marked declines in production, sales and employment during June as strikes receded around midmonth. Factory gate charges meanwhile rose at an unprecedented rate as input cost inflation climbed to a near survey peak.

The June PMI reading for the Mexican manufacturing industry was the best since February 2020, but remained in contraction territory. There were softer reductions in output, new orders, exports and employment. Input cost inflation quickened, but companies continued to lower selling prices amid ongoing efforts to secure new work.

Looking ahead, 2021 GDP forecasts reported by the IMF in its April world economic outlook update were revised higher for Argentina (+5.8%), Brazil (+3.7%), Colombia (+5.2%) and Mexico (+5.0%). PMI data indeed showed improved sentiment towards growth prospects among firms in Brazil, Colombia and Mexico.

Brazil

Brazilian economic activity returned to pre-pandemic levels in the opening quarter of 2021. From last year, GDP grew 2.3% whilst expanding 1.2% from the prior quarter. The IMF adjusted the 2021 growth projections reported in January (+3.6%) to +3.7% in April.

Compared with Q1 2021, there was an improvement in the PMI Composite Output Index during Q2 as a strong manufacturing sector performance offset weakness in services. The latter was heavily impact by the new wave of COVID-19 and local restrictions, posting a substantial decline in business activity during April. Service providers noted tentative signs of a recovery in June, with a solid increase in new work intakes underpinning job creation and a renewed rise in output. With growth sustained among goods producers, June saw the reinstatement of expansions in private sector output and jobs.

This is good news given that Brazil's unemployment rate remained stuck at a record high of 14.7% in April. With survey data showing that companies are more upbeat towards the outlook due to growing vaccine coverage, improvements in labour market statistics are expected in coming months should the pandemic retreat.

Brazil's central bank hiked interest rates for the third time in 2021 during June to restrain inflation. The SELIC currently stands at 4.25%, the highest since February last year, but still one of the lowest in the past two decades. June PMI data pointed to near-record increases in input costs and output prices across the private sector amid raw material scarcity and supply-chain disruptions, suggesting that a further hike to interest rates is on the cards.

Colombia

Colombia's manufacturing industry was greatly impacted by national strikes and blockades that took place parallel to a new wave of COVID-19 infections. PMI survey data showed renewed declines in factory orders, production, input purchasing and employment in May. All of these measures remained in contraction territory in June, but rates of reduction softened as strikes receded mid-month.

Official GDP data showed a further recovery in economic activity during Q1 2021. The annual growth rate was at 2.0%, but the quarter-on-quarter expansion eased to 2.9%. The IMF expects GDP to increase 5.2% this year, an upward revision from 4.6% in January but a figure that may be lowered following the negative impacts of strikes.

In May, the unemployment rate rose to a three-month high of 15.6%, but the impending return to more normal conditions, vaccine progress and an improvement in manufacturing sector confidence could underpin job creation in the second half of the year.

Mexico

Mexico was the only major nation in Latin America to post a contraction in year-on-year GDP (-2.8%) during Q1 2021. Quarterly growth eased from 3.2% to 0.8%. However, improved vaccine access, the lifting of restrictions, growth among major export partners and low interest rates bode well for the outlook. The IMF forecasts a 5.0% upturn in GDP during 2021, an upward change from 4.3%. The official interest rate was raised for the first time in 2021 during June, from 4.0% to 4.25% to anchor inflation expectations.

PMI data continued to highlight elevated price pressures in the manufacturing industry, but firms again refrained from passing these on to clients amid subdued demand conditions. June saw further, albeit softer, declines in sales, exports and production. Encouragingly, business confidence climbed to a 17-month high.

Argentina

With the pandemic retreating, fiscal incentives in place and global domestic demand improving, economic prospects for Argentina look brighter.

After predicting GDP growth of 4.5% in 2021, the IMF now forecasts an upturn of 5.8%. The unemployment rate is anticipated to be at 10.6% at the end of the year, slightly higher than the rate in Q1 of 10.2%.

The key threats to growth prospects in Argentina include the pandemic, peso weakness, high debt, a wide fiscal deficit and still high inflation. As has been the case since last November, the official interest rate was at 38% in June.