Latin American inflation recedes, easing pressure on interest rates

Pollyanna De Lima, Economics Associate Director Economic Indicators & Forecasts, S&P Global Market Intelligence, crunches the latest numbers from the region...

Overview

Despite facing headwinds such as price pressures, elevated interest rates, policy challenges and weak global demand conditions, Latin American economies performed generally better than anticipated in the opening quarter of 2023. In Brazil, Colombia and Mexico, inflationary forces receded from the highs seen last year amid stringent monetary policy tightening, better supply-chain conditions and reduced energy price volatility.

That said, looking ahead, inflation rates generally remain above central bank targets and the S&P Global PMITM data showed manufacturing sector weakness across the three aforementioned nations in May.

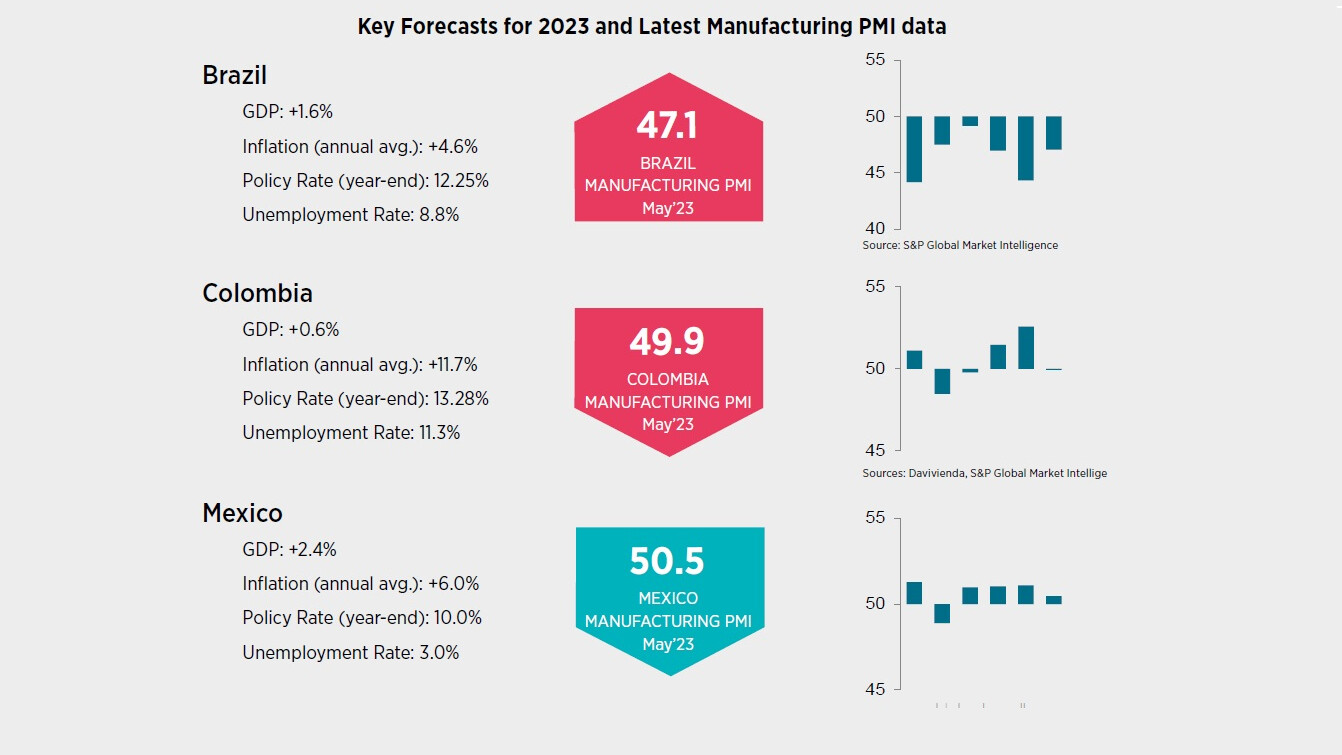

We forecast economic growth of +1.6% and +0.6% for Brazil and Colombia respectively in 2023, the same as when the magazine was last printed in February. Mexico’s GDP estimate was upgraded from +1.6% to +2.4%, owing to a robust performance in the opening quarter of the year, service sector resilience, positive consumption trends and favourable nearshoring prospects. Expectations that policy interest rates have peaked, logistics disruptions will continue to fade and inflation will recede further were incorporated in our forecasts.

While high borrowing costs, fiscal challenges, economic slowdowns among trading partners, stubborn inflation and declining living standards all pose downside risks to the outlook, the region could benefit from several promising prospects. Among them are renewable energy opportunities, infrastructure investments, service sector resilience, structural reforms, nearshoring trends and the chances of positive crop yields.

Brazil

Brazil’s PMI data, compiled by S&P Global, portrayed an economic landscape of sectoral divergence. Manufacturing has struggled in recent months, while services played a vital role in driving growth. Differences in demand dynamics across the two segments also showcased variations in inflationary trends.

In May, the manufacturing PMI results revealed continued declines in factory orders, production and employment. Positive developments included an unprecedented improvement in supplier delivery times, a fall in input costs and discounted selling charges. According to monitored companies, historically high prices, elevated borrowing costs and public policy worries dampened demand for Brazilian goods, with firms also noting the cancellation and postponement of existing orders.

Conversely, improving demand for services spurred growth across Brazil’s dominant sector. Business activity, new orders, and employment all expanded solidly in May. Meanwhile, despite slowing down input cost inflation remained rapid and output prices increased at a faster pace.

Brazil’s inflation rate for monetary policy target eased for the third month running in April, standing at +4.2% and moving within the central bank’s tolerance interval. While this bodes well for interest rate prospects, the PMI continued to point to some degree of price stickiness as services plays catch-up with manufacturing. We nevertheless forecast cuts to the SELIC, which is anticipated to end the year at 12.25%.

Meanwhile, real GDP is projected to expand +1.6% in 2023 and the unemployment rate to end the year at 8.8%.

Colombia

After posting robust growth at the start of the second quarter, Colombia’s manufacturing industry faced some difficulties in May. The Davivienda PMI survey showed a renewed decline in production, primarily due to adverse sales developments, political uncertainty, low investment and inflationary pressures. Subsequently, businesses made downward adjustments to operating capacities by trimming workforce

numbers. Increasing cost pressures prompted companies to limit input purchases, while sales-boosting initiatives curbed charge inflation.

Although the official inflation rate eased to a five-month low of +12.8% in April, it remained among the highest over the last 24 years and well above the central bank’s upper limit of 4%. Convergence towards the central target is only expected in 2025, with no cuts to the policy interest rate predicted for 2023.

Our forecast for consumer price inflation (annual average) stands at +11.7%, driven by soaring service, fuel and food prices as well as wage adjustments and peso volatility.

As for economic expansion, we project real GDP growth to slow to +0.6% in 2023 as price pressures and elevated interest rates dampen consumption and investment.

On the subject of the labour market, the unemployment rate (currently at 10.7%) is anticipated to end the year at 11.3%.

Mexico

Mexican manufacturing orders declined in May, PMI data showed, reportedly owing to sluggish market demand and clients’ limited access to credit. Although this had a negative impact on production levels, rates of reduction on both fronts were negligible. Cost pressures receded to the weakest in 20 months, thanks to improved exchange rates and lower international prices for several inputs. Manufacturers’ pricing power was limited by competitive pressures, a key factor leading to an increase in charges that was nonetheless only marginal.

At +7.7%, annual core inflation remained historically high in April, prompting the central bank to tighten monetary policy further. The interest rate was raised to a new record of 11.25%. Looking ahead, we forecast inflation (annual average) and interest rates (year-end) to post +6.0% and 10.0% respectively.

Buoyant consumption trends, service sector strength, light vehicle sales to the US and the potential for large-scale nearshoring all supported an upward revision in our projections for real GDP in 2023 (+2.4%). Finally, the unemployment rate is predicted to end the year at 3.0%.