Exclusive Interview with Marcelo Montenegro, Bolivia's Minister of Economy and Public Finances

Bolivia is transforming its economic model and opening up to international investors. Minister Montenegro, highlights the best opportunities...

Will Bolivia’s economy struggle to cope with the decline in natural gas exports?

Minister Montenegro: No – there are several reasons why it won’t. The main reason is that the government of President Luis Arce, is diversifying the economy to give more strength to the lithium business. Yes, it’s true that we import diesel because we are a gas producer, rather than an oil producer. However, we are going to substitute diesel imports with ethanol and methanol plants. We will also mix these biofuels with conventional fuels to reduce our oil import costs. But it would be mistaken to believe that the Bolivian gas era is over. Over the last six years there was a drop in gas exploration, so now President Arce has instructed the state hydrocarbon company YPFB to search for more gas and discoveries are already being made.

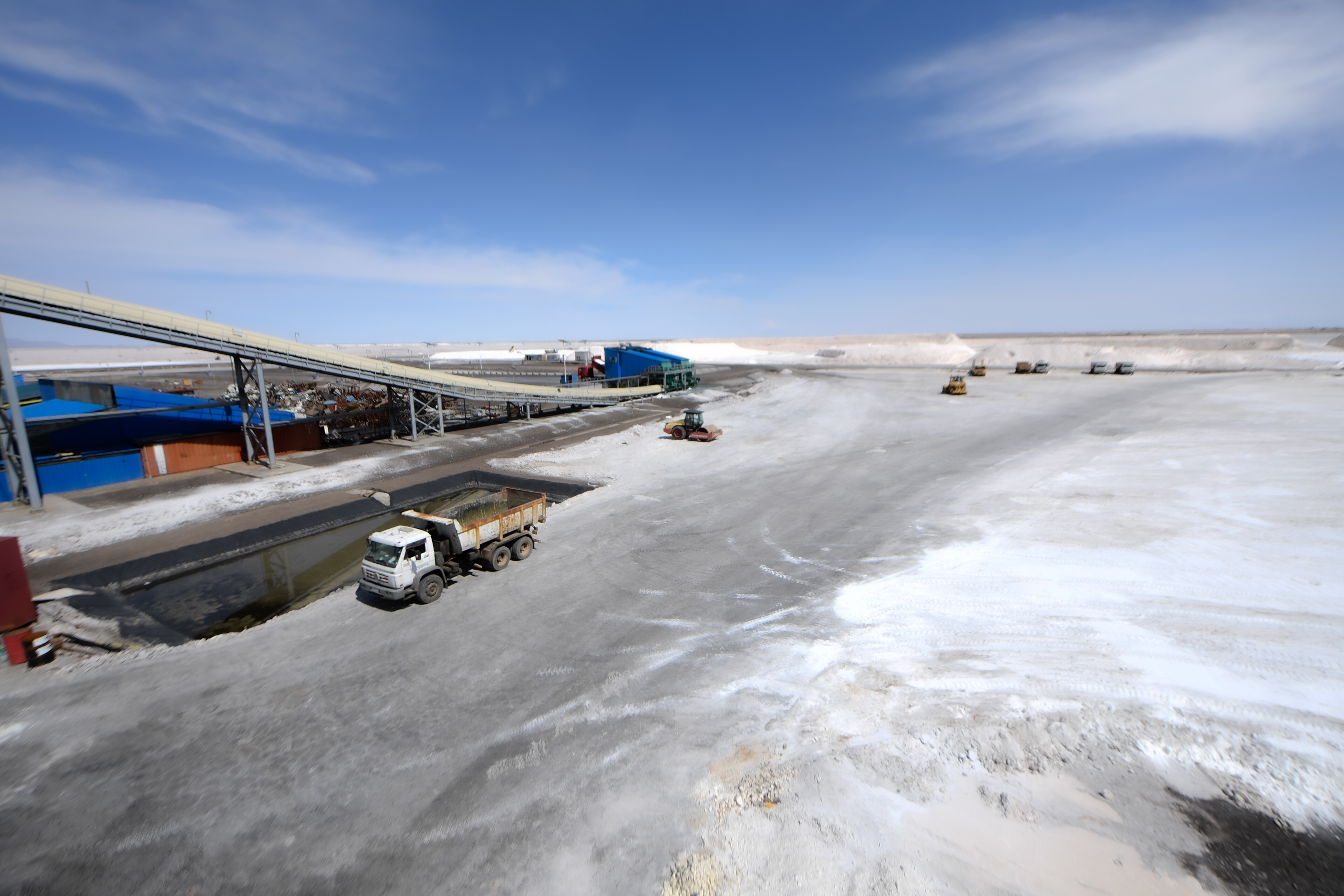

Away from gas, there are incredible opportunities, as we diversify our economy. One boom area is agribusiness. I recently travelled to Beni province, where I saw first-hand how farmers are increasing the yields of corn and soybean. The advances are incredible, with productivity being quadrupled on some farms. Bolivia also managed to kickstart its beef export industry, which was practically non-existent twenty years ago. We have exotic amazonian fruits with high export potential and we have seeds like Chia that are very popular with Chinese consumers. We also have potential in tourism – especially in Uyuni salt flat, which is unique in the world and would be ideal for high-class, environmentally-friendly tourism.

It would be mistaken to believe that the Bolivian gas era is over. Over the last six years there was a drop in gas exploration, so now President Arce has instructed the state hydrocarbon company YPFB to search for more gas and discoveries are already being made.

On the mining side we have gold. Indeed, many Swiss banks now prefer Bolivian gold bars as a deposit over euros or dollars. At the moment many of our mines use mercury to extract the gold, but we are implementing a programme that encourages mines to use international technology to use less mercury. The same applies to zinc, where we are building processing plants that help us get more value from the metal. That plant, which will need foreign capital and technology, will be built in Potosi, the historical centre of the Bolivian mining industry.

Our only weakness is that we don’t have direct access to the sea – which means we have to get on with our neighbours – but president Arce is pushing this diversification and we have a lot to offer.

Bolivia has the world’s largest lithium reserves; how do you plan to develop them?

MM: Lithium is our most attractive investment area. We already have agreements with a Chinese consortium and a Russian consortium and we are in negotiations with an Australian lithium company. Our approach is to create space for investors from around the world. We encourage them to build pilot plants to prove their concept works in our conditions and then see them scale it up. We want to build lithium carbonate and lithium hydroxide plants so we can be active in all parts of the market. We are also keen for companies to add value to lithium locally by producing lithium cathodes or even batteries.

We think it makes sense to start with small pilot projects, because it helps us deliver results quickly. The massive projects take more time and we want to show the Bolivian people that these partnerships with international players work. So, we are targeting plants that produce 2,500 to 14,000 tonnes of lithium per year. I think the pilot plants, also help convince the international groups that Bolivia is a good place to develop lithium projects.

Every country takes its own approach. In Argentina the mineral resources are owned by each province, which has led to them inviting a multitude of private sector companies to develop the resources. In Chile, you have state players like Codelco, that partner the private sector. In Bolivia we sign individual agreements with each international company that wants to develop our lithium. Each agreement needs to be approved by congress, which is good because it gives both sides more security. The international companies bring their technology and know-how and we share the profits. These agreements are governed by our Investment Law – not a particular lithium law. So far, the feedback from the investors indicates that they appreciate the system because it ensures alignment of interests.

Is Bolivia ready to reach out to investors?

MM: We have permission from Congress to issue bonds in international financial markets for $2billion. Of course, interest rates are high at the moment but we are working with leading investment banks, such as Goldman Sachs, Bank of America Merryl Lynch and Deutsche Bank to go to the market with a small emission that will make it clear that Bolivia is ready to return to international capital markets. We issued a bond in 2022, but the conditions didn’t make sense for another issuance in 2023.

We will go on an investor roadshow to help them understand the opportunity. We will also take advantage of any window of favourable interest rates. I think most investors don’t realise the strong economic growth that will come from our diversification programme.

We are also exploring a green bond emission. The only delay with the green bond is that we have so many clean energy projects – such as solar and wind power plants – plus climate change resilience plans, that we need to register. Once they have been registered, we will look at issuing the bond. One advantage we have is that we can issue the green bond through the BDP (Banco Desarrollo Productivo) – a Bolivian development bank that includes respected, regional development bank, CAF, as one of its shareholders.

Over the last 15 years Bolivia has expropriated the assets of international companies; why is that no longer a risk?

MM: We have an investment law the guarantees all of the rights and investment of any foreign company in Bolivia – in full accordance with Bolivian law. Of course, these international companies’ activities have to fully comply with Bolivian regulations.

Our preferred method of working with international companies is to enter into strategic partnerships with them. We don’t like PPPs because we think that is a weak relationship, instead the Bolivian state wants companies that will be our partners. The make-up of the partnership – ie 60%/40% ownership split etc – can change depending on the specific agreement.

Investors can also take comfort from the fact that the government of Luis Arce has not expropriated any international assets. Indeed, we have signed successful partnerships, such as with the Chinese and Russian consortiums in lithium.

Bolivia recently joined Mercosur; how will that boost growth?

MM: Mercosur is an economic block, comprised of Brazil, Argentina, Uruguay and Paraguay. Providing goods to just Brazil would give a massive boost to Bolivian exports. For example, Brazil is currently importing cement from Africa, which is crazy because we have a surplus installed capacity of cement that we could sell to Brazil.

But it’s not just cement. Brazil is demanding lots of food, raw materials and supplies, especially in the frontier zones next to Bolivia. Meanwhile the massive improvements that we have made to productivity mean that we can supply them. For example, in Beni we have boosted the output of corn from 4 tonnes to hectare to 18 tonnes per hectare by using precision agriculture. Ethanol is another area with exciting export potential as Brazil is a world leader in producing ethanol car motors. So, Mercosur isn’t just an exciting opportunity for the future, it’s is already creating business in the present.

What will Bolivia’s economy look like in 2030?

MM: In 2023 our exports were $11.5billion dollars – that will grow exponentially in the coming years. We have the capacity to boost those exports now, without major investment. And with some investment, which is what we are looking for, the opportunities multiply.

This government has already begun the process of economic diversification and whoever comes to power next will inherit a different economy. Today we are growing at almost 3% and in 2030 we will be the fastest-growing economy in South America. Today we already benefit from the second-lowest inflation in South America, with the best post-pandemic recovery in employment in the region and a tax take that is back to pre-pandemic levels.

That stable macroeconomic backdrop provides the security for investors coming to Bolivia. While the opportunities are being created by the economic diversification. Bolivia hasn’t achieved its economic potential and as it strives to do so, it will create exciting investment projects for investors.